An expense sheet template is a professional format which everyone needs to buy things and services they spend money or at a certain situation they spent something to attain or accomplish their goals in return. All the process and even more, they require money along with a smart system where they can manage their expenses. Well, in the era of modernism and technology, everyone busy to accomplish their objectives. It is obvious, people have less time to manage their things, in this scenario they need a system that intuitively track their day-to-day expenses in a well-qualified manner. Actually, the underwhelming system will provide a way to keep track of expenditures and quietly control the useless expenses that draw back to their lives or black spotting to their business, likewise. An expense sheet template is a perfect example which can solve their problems.

Importance of Expense Sheet

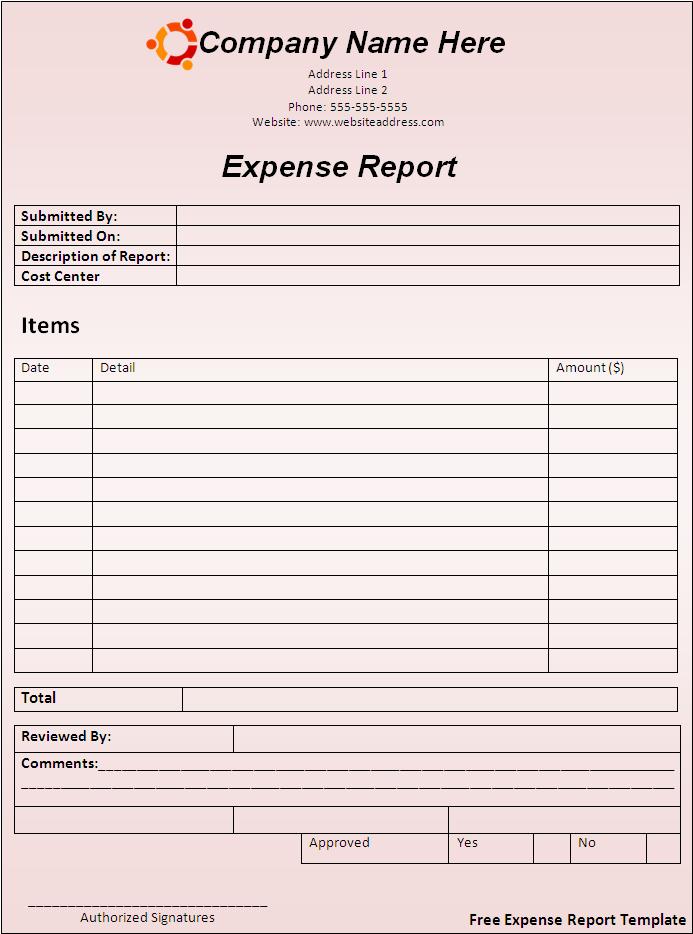

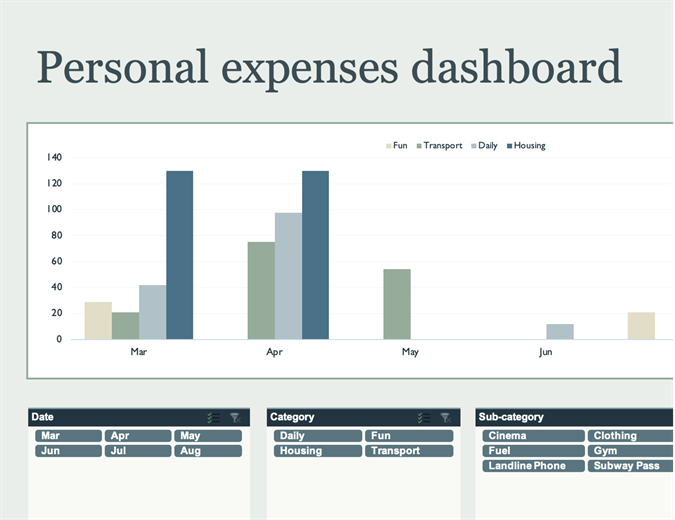

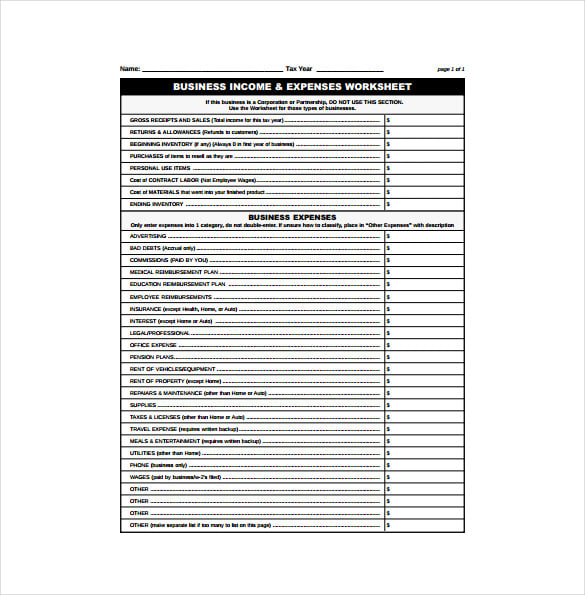

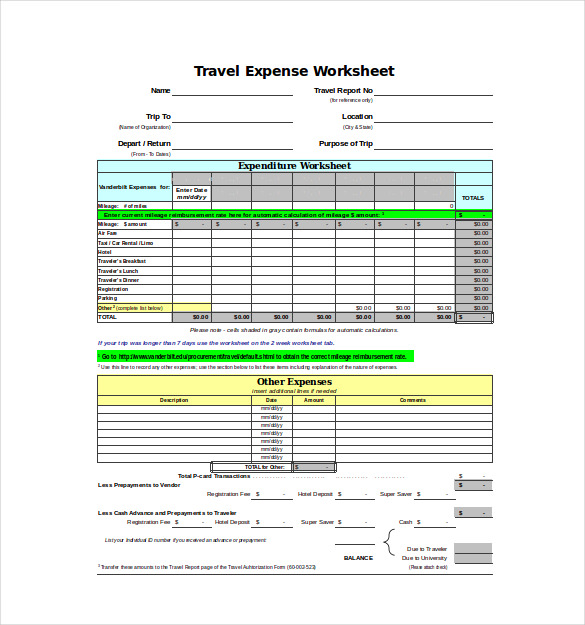

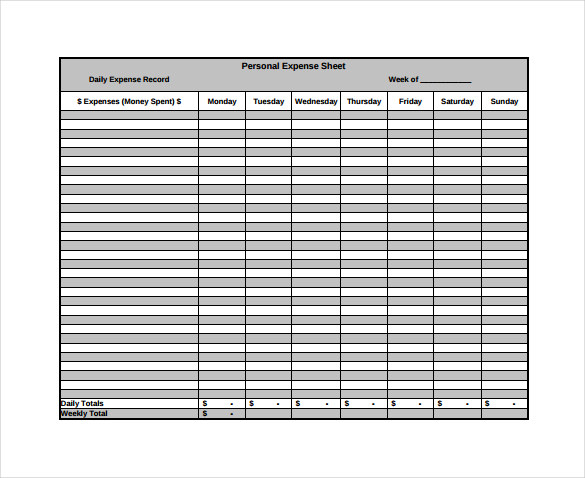

In terms of usage, it’s so difficult to control and track on expenses. However, an expense sheet template is a document where you can include all the details related to the stuff as paperwork elements, it’s a sure thing in return definitely you have a flourish business and personalized life. No doubt one can easily track on expenses with the help of concise component of expense sheet template, an ultimate expense sheet assist you to spend more time to earn and less time to manage your expenditures, because a compact structure of expense sheet lead you to manage your expenses professionally. There are a number of programs available online to create an innovative expense sheet template, but the MS Excel sheet gives you an effective way to manage and control expenses in a specialized manner.

Details of Expense Sheet

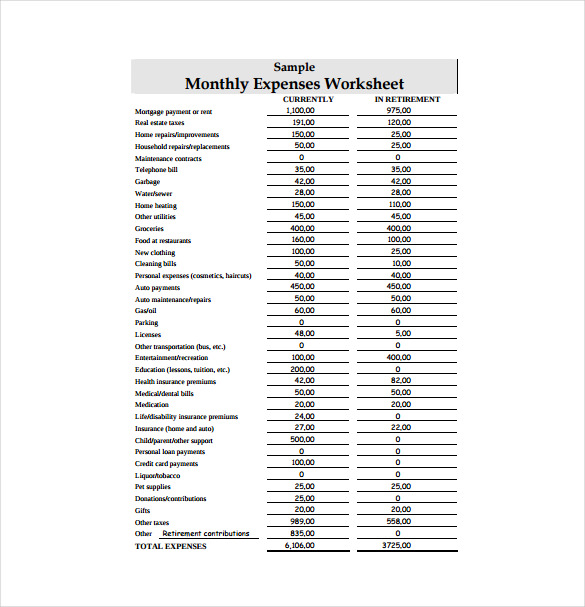

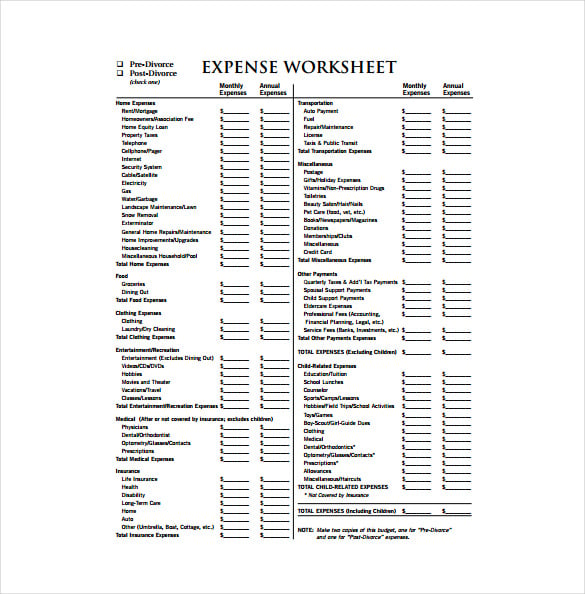

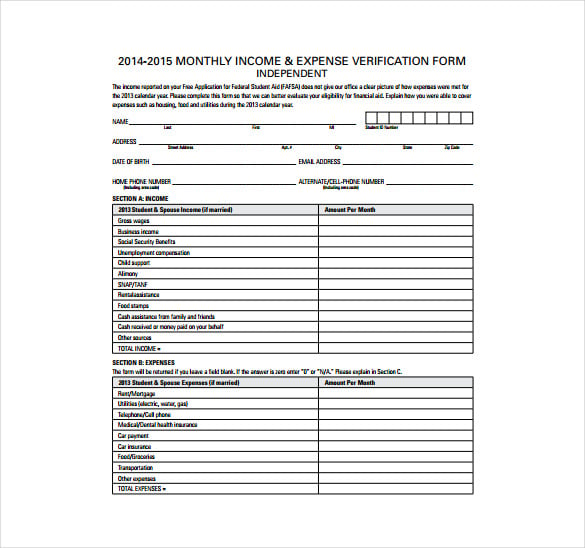

For certain, if a person is willing to prepare an expense sheet template, then he/she can break down their expenses in snippets to determine how much they have to spend or how to control unnecessary expenditures. Well here are a number of points that a general expense sheet may include, for instance; applicant’s name, head of holding net income, spouse income, extra income, total income, total expense, savings, expense of several things, food, clothing, medical, transport, auto, gadgets, living expense, extra expense, special debts, insure money and total monthly amount.